As one of the critical areas of the economy, banking is influenced by an increasing number of external factors.

Adapting to dynamic regulatory modifications and keeping up with changes in the highly competitive market, in terms of both the business offer and the manner of providing services, are the everyday challenges faced by contemporary banking institutions.

They must boldly expand the spectrum of their services and products, while also getting closer to the end customer, by providing them with modern access channels to their offer and the highest possible quality and speed of service. The critical role here is played by the optimal (also in terms of cost efficiency) selection of technologies and IT tools that allow for the implementation of modern technological patterns, while ensuring an appropriate level of security for devices created with their help.

What market challenges is the financial services industry facing?

Growing competition

As fintech start-ups introduce new forms of banking, payments, and other services, many financial institutions need to innovate to keep up. Whether it is introducing new features or updating existing solutions, changing consumer tastes can trigger actions which help ensure that goals continue to change for the foreseeable future.

Low-code for fintech

It can be noted that fintech companies focus more on user experience management and thus gain a substantial competitive advantage over traditional financial institutions that do not. Therefore, traditional banks must embrace the digital revolution, to keep up with their modern market competitors.

Low-code solutions help in adapting to the constantly changing market challenges and the growing consumer expectations. They enable financial institutions to quickly introduce new functions and update their offers with less effort.

Dynamic legislative changes

In banking, many business processes are subject to frequent modifications linked to legislative changes. Financial institutions store not only large funds, but also extremely sensitive information about their clients. Therefore, they are subject to systematic control and surveillance of their governing bodies.

The need for the financial sector to adapt to ever-new regulations is an element of the everyday reality of banking institutions. They must ensure that there no misuse or mishandling of user data can occur. Compliance with strict procedures is a major administrative and operational challenge that must be handled with due precision.

At the same time, they bear a huge social responsibility, which was particularly visible during the pandemic, when banks played a fundamental role in supporting enterprises by efficiently introducing countermeasures and quickly implementing the forms of assistance proposed by the government.

Low-code solutions help financial institutions automate time-consuming procedures, free up organizational resources, and make time for other business processes.

Growing consumer expectations

Many customers have switched to virtual or Internet solutions, when dealing with financial institutions. This means that, to keep up with the competition and meet users’ needs, financial institutions must invest in customer service solutions.

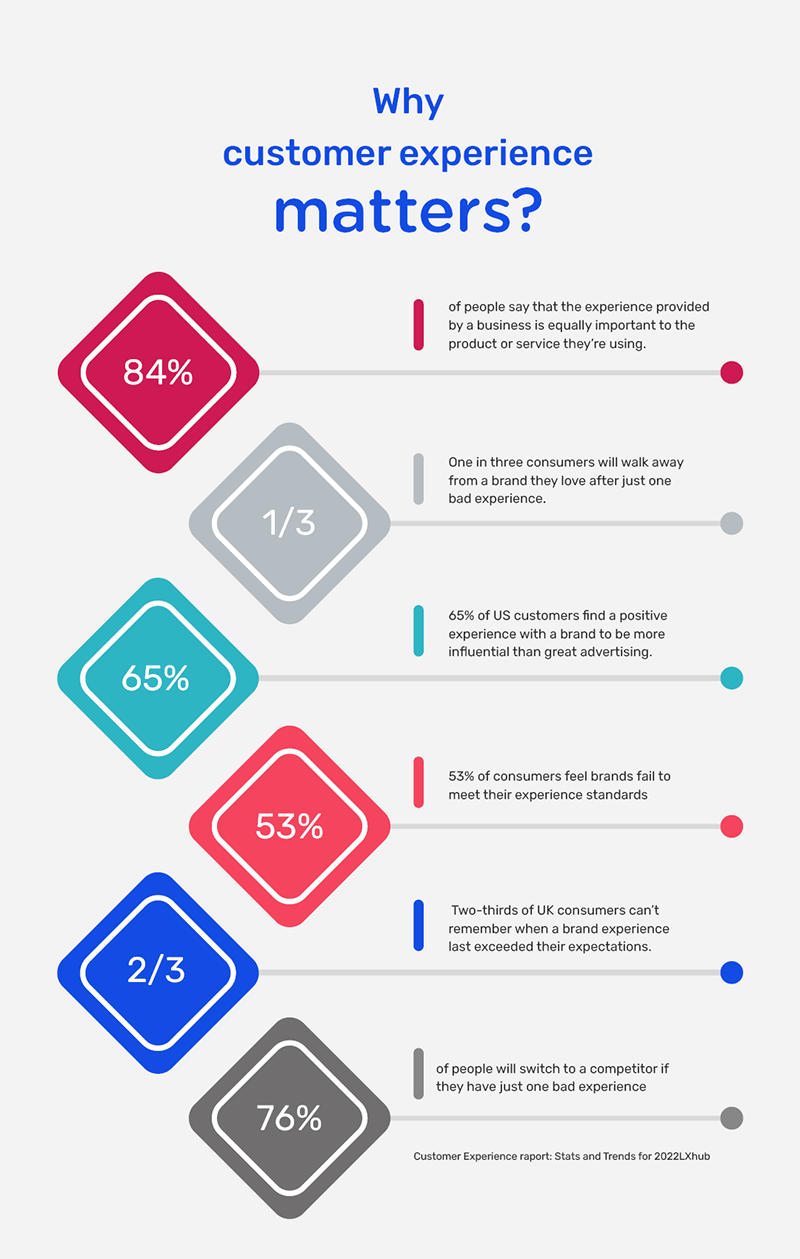

Today, consumers want to be served, informed, and engaged. Research has shown that 66% of customers expect companies to understand their unique needs and expectations. Institutions that adapt to the modern customer’s mindset and offer personalization in their services increase customer loyalty.

Financial organizations can provide the highest quality of customer experience, with the use of intelligent digital platforms. Using low-code technology allows you to shorten the time it takes to generate new solutions, while standardizing the approach to their creation.

This helps financial institutions meet the growing expectations of consumers.

Automation of banking processes thanks to BPMS platforms and low-code technology

With the use of low-code, financial institutions can automate various processes which were previously conducted manually, thus saving time for both employees and customers.

Protecting customer assets and data is one of the biggest challenges that banks need to face daily. Financial institutions are tasked with collecting, managing, storing, and analyzing large amounts of data and information, which can be difficult, if done manually.

Modern BPMS platforms are the most effective tool for automating business processes. They will work well even in regard to the most complex paths which are scattered across the organization, which involve employees from many areas of operation, and which require integration with many external systems.

Solutions created with the use of the low-code approach are characterized by high flexibility and are easier to implement and subsequently develop.

It is also worth noting that the BPMS platform collects and provides a lot of detailed information on the course of the entire process, which significantly facilitates its monitoring (especially in terms of SLA) and further optimization. It also provides a complete set of information for a potential audit.

Cooperation of institutions from the financial sector with Clocklike Minds

At Clocklike Minds, we have helped automate many sales and service processes in the banking sector. The consultants from our company co-created a solution for one of our foreign clients, which automates sales and service processes in the field of banking products and customer data.

This allowed the Customer’s own facilities and their partner outlets to directly carry out most of the required operations, without the need to involve the Customer’s central service team. Thanks to this, they were significantly relieved from the implementation of repetitive tasks.

The automations implemented by us enabled, among others:

- the sale of cards (credit, debit, pre-paid),

- the after-sales customer cards service (activation and blocking of cards, setting limits, topping up cards and others),

- the after-sales customer data service (change of personal data, address, etc.),

- defining new partner units and management of the existing partner network by the Client’s employees,

- management of users belonging to the partner business unit directly by the employees of the partner unit (creating users for new employees, blocking them, changing passwords, etc.).

The implementation of the solution rendered the employees of partner outlets significantly more independent in carrying out most of the required service operations. In particular, it accelerated sales processes, eliminating the need to use traditional paper applications and, at the same time, actively supporting the seller in the process of collecting the required data and documents.

All of it was possible thanks to, among others, the dynamic adaptation of process flows to the sold product, the high-quality UI/UX, and the contextual help provided to the user at every step, which was ensured by the modern, leading BPMS platform and the high specialization of our team.

Creating highly functional, complex solutions tailored to the needs of your financial institution and consumer expectations is our most important task. Thanks to this, you stand a better chance when facing a highly competitive market.

Traditional banks have not always been at the forefront of technological innovation, mainly due to the high complexity of business processes, as well as the regulations that they must comply with on a daily basis. However, these days, quickly creating features that add value to users is essential.

Low-code solutions manage both of these problems, enabling financial institutions to introduce new features quickly. With less code to worry about, banks and other industry supporters can maintain and update their offers with less effort.