Low-code platforms can make insurers more flexible, more competitive, and better adapted to the digital world. A strategic and comprehensive approach to a digital transformation can allow companies in the insurance sector to create new products and processes tailored to users’ expectations. It is also essential for the insurance sector to adapt to dynamic changes in regulations, without spending a lot of time remodeling the platform or building it from scratch.

Financial supervision requirement

In the insurance industry, we are increasingly dealing with “making products public” (a requirement of financial supervision), which makes them much easier to compare and to be copied by competitors. The insurance market is slowly becoming a “commodity” market where products can be fairly easily compared.

Insurance companies can focus more on user needs and become genuinely customer-centric by quickly adopting new regulations, without spending a lot of time remodeling or rebuilding the platform from scratch.

Customer experience – the best way to compete for customers in the insurance sector

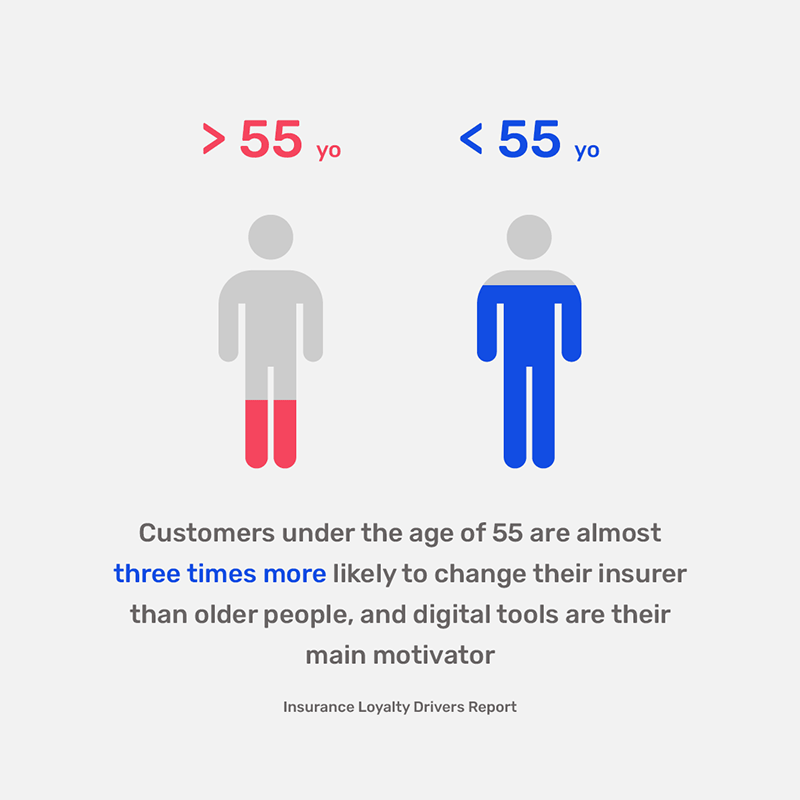

Today, customers expect complex solutions which are tailored to their needs and which will effectively meet those needs. When an insurer fails to provide the right product or the right level of service, the dissatisfied clients knock on the door of the competition – just a few clicks is enough to change their brand. That is why it is so important to be able to quickly introduce new solutions to the market and promptly modify existing products or services.

Low-code insurance

Faced with a rapid pace of innovation, the insurance industry must create technologies that meet the growing customer demand for digital experiences.

This strategy can be implemented by:

- building relationships with the client, thanks to excellent knowledge of their situation and active dialogue during interaction

- personalization of the offer, in the context of the client’s life situation, their needs, and their loyalty to the company (Next Best Action)

- reaching the client through various communication channels and consistency during service provided within each of them

- simplifying, automating, and quickly adapting business processes to the changing market conditions and customer needs

Cooperation of institutions from the insurance sector with Clocklike Minds

Our consultants have extensive experience in implementing projects for the insurance industry. Here is a description of some of the implementations in which we have participated:

1. Operational CRM

Building an operational CRM to improve customer experience and improve service efficiency.

The implemented functionalities included, among others:

- Management of interactions with customers (telephone, email, www)

- 360 customer view and one service app instead of six

- Typical processes for Operations, Sales, and Marketing

- Management of customer and agent complaints and matters

- Marketing campaigns – welcome call, NPS, customer retention

2. After-sales service for a complex insurance product

This service was carried out on the BPM platform, because the transaction system was not adapted for implementation of processes. The development time on the BPM platform was much shorter, and the delivered solution was much more flexible.

The functionality included:

- Possibility to introduce changes to the policy, within its duration

- Complex premium calculation and validations

- Monthly policy changes

- Underwriting support (loading and exclusions)

3. A solution for assessing the risk linked to insurance products (Underwriting)

Designing, implementing, and maintaining an application for underwriting a health product with life insurance.

The assessment process consists in evaluating the insurance application, which may result in the following:

- Refusal to issue the policy

- Postponing the issuance of the policy

- Increasing the premium

- Excluding some scope of protection

- Standard policy issuance

The application’s functionality included non-standard case routing, integration with the Document Management System, and a printing mechanism.

The above examples of implementations do not exhaust all possibilities for utilizing the low-code/bpm platform in the insurance sector. There are many other areas where low code can help insurers stay competitive and provide better customer service. If you are interested, our experts will gladly tell you more about it.